Where Bank Account Number On Check - is a question that many people ask themselves when they need to provide their account number for various transactions. The good news is that finding your bank account number on a check is relatively easy. All you need to do is to take a closer look at the check and locate the different pieces of information contained on it. In this post, we'll show you how to find your bank account number on a check and explain what e-checks are and how they work.

How to Find Your Bank Account Number on a Check

Almost all checks contain the same basic information, which includes the date, the payee, the amount, and the signature of the person who wrote the check. If you flip over the check, you'll notice that it also contains a series of numbers that identify your bank account. Here are the steps to follow to find your bank account number:

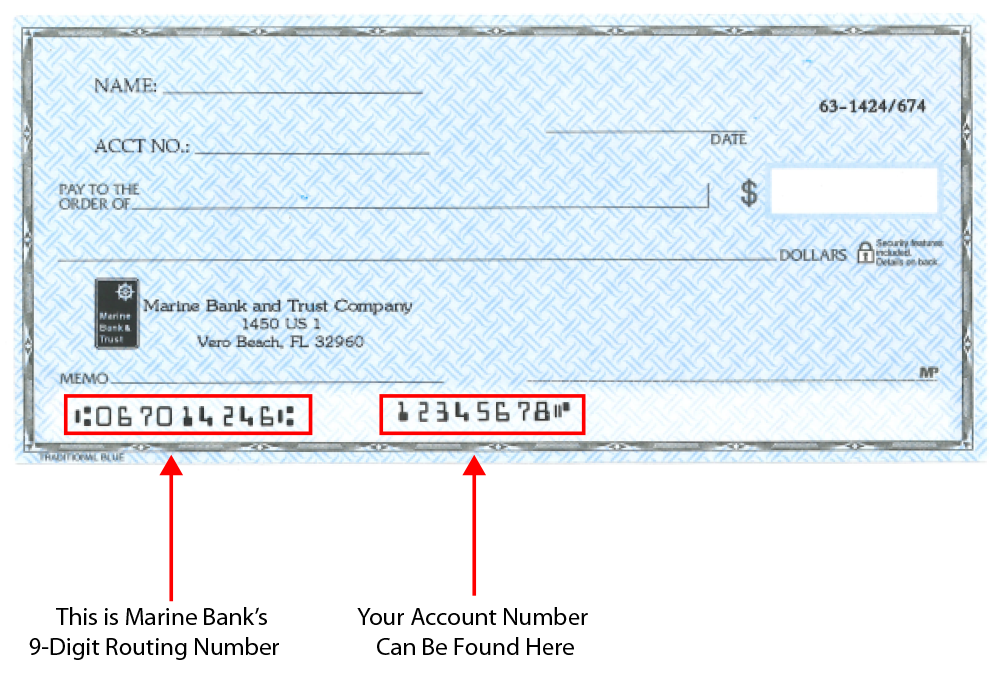

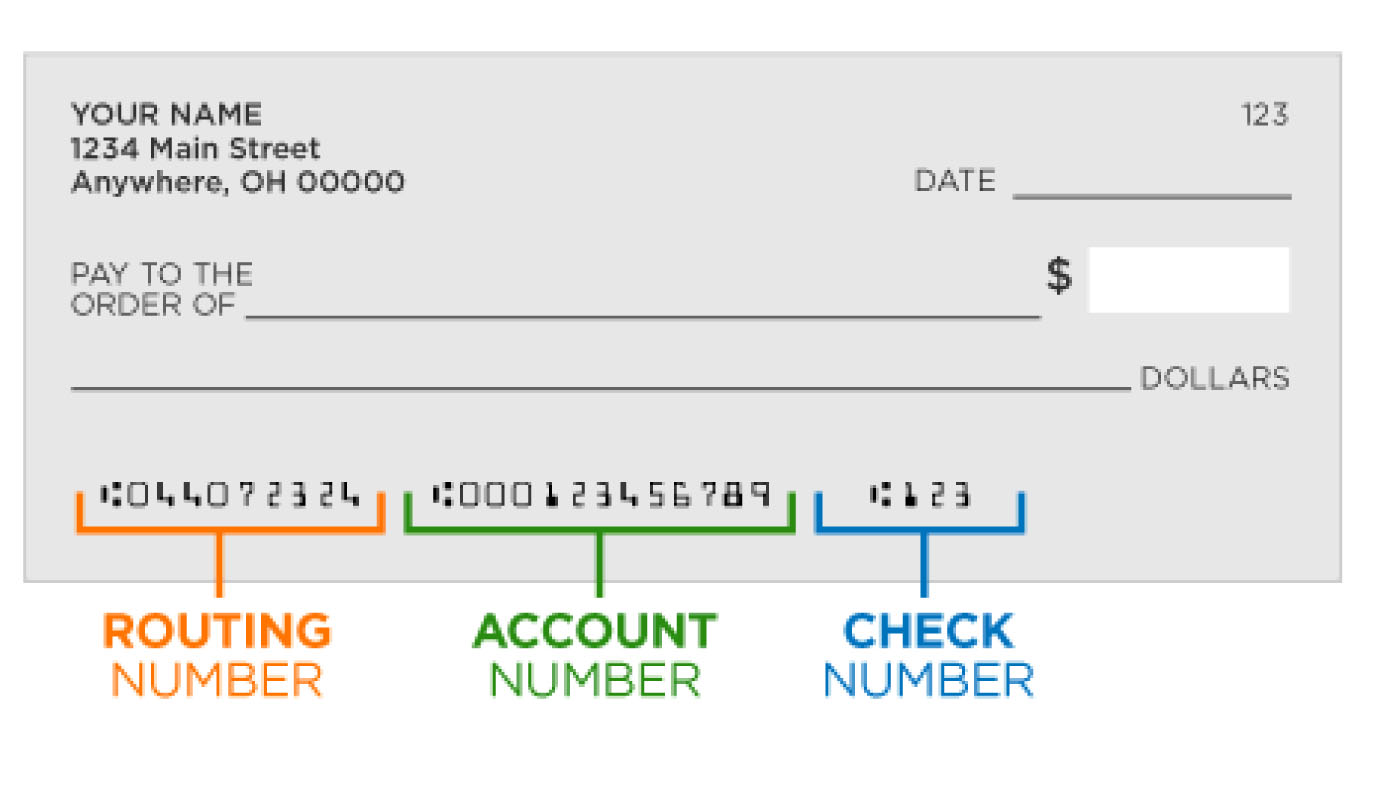

Step 1: Identifying the Routing Number

The first step is to find the routing number, which is a nine-digit number located at the bottom left-hand corner of the check. The routing number identifies the financial institution that issued the check, and it helps to ensure that the money is transferred to the right account. The routing number is usually the first set of numbers on the bottom of the check, and it's followed by the account number.

Step 2: Finding the Account Number

The second step is to find the account number, which is usually located next to the routing number. The account number is typically between 8 and 12 digits long, and it identifies the specific account that the check is linked to. You'll notice that the account number is usually followed by a symbol such as a colon or a dash.

What Is an E-Check?

Now that you know how to find your bank account number on a check let's talk about e-checks. An e-check is a digital version of a paper check that's delivered over the internet. E-checks are often used to make online payments, and they're becoming increasingly popular because they're more convenient and more secure than traditional paper checks.

How E-Checks Work

When you make a payment with an e-check, you'll typically be asked to provide your bank account number and your routing number. Once you've entered this information, the payment processor will use it to create a digital version of your check. The check will then be sent to your bank for processing, and the funds will be transferred from your account to the merchant's account.

Tips and Ideas for Using E-Checks

If you're considering using e-checks for online payments, here are some tips and ideas to help you get started:

1. Verify the Merchant

Before you make a payment with an e-check, be sure to verify the merchant's identity and reputation. Look for reviews and testimonials, and check the Better Business Bureau to see if there are any complaints against the merchant.

2. Use Encryption

When you're making an e-check payment, make sure that you're using an encrypted connection. Look for the padlock icon in your browser's address bar, which indicates that the connection is secure.

3. Don't Share Your Bank Account Information

Never share your bank account number or your routing number with anyone you don't trust. This information can be used to withdraw money from your account without your permission.

4. Keep Records

Be sure to keep records of all your e-check transactions. Save a copy of your payment confirmation email, and keep it in a safe place in case you need to reference it later.

How to Protect Yourself from E-Check Fraud

While e-checks are generally safe and secure, they're not immune to fraud. Here are some steps you can take to protect yourself from e-check fraud:

1. Monitor Your Account

Always monitor your bank account for any unauthorized transactions. If you notice anything suspicious, contact your bank right away.

2. Set Up Fraud Alerts

Consider setting up fraud alerts with your bank. This will enable your bank to notify you if there are any unusual transactions or suspicious activity detected on your account.

3. Use a Reputable Payment Processor

Make sure that you're using a reputable payment processor when making e-check payments online. Look for companies with a track record of delivering secure and reliable payment processing services.

4. Don't Click on Suspicious Links

Be wary of emails or text messages that ask you to click on a link to make an e-check payment. These may be phishing scams designed to steal your personal information.

Conclusion

Knowing where to find your bank account number on a check is important if you want to make online payments with an e-check. Make sure that you follow the tips and ideas we've provided to help protect yourself from e-check fraud. Most importantly, always monitor your bank account for any unauthorized transactions, and contact your bank right away if you notice anything suspicious.

Read more articles about Where Bank Account Number On Check