Where Did The Dow Close Today - The Dow Jones Industrial Average is one of the most widely followed benchmark indexes in the world. It consists of 30 blue-chip stocks that trade on the New York Stock Exchange (NYSE) and the NASDAQ. Investors use the Dow as a gauge of the overall health of the stock market and the economy. Here's a look at what the Dow Jones Industrial Average did today, as well as some tips, ideas, and strategies for investing in this market.

What is the Dow Jones Doing Today?

Snomad

The Dow Jones had a rough day today, with the market experiencing choppy trading conditions. Investors were on edge as they focused on a number of global growth concerns, including the ongoing crisis in Greece and the possibility of an economic slowdown in China. Despite these headwinds, the Dow Jones Industrial Average managed to hold onto modest gains for much of the day before selling off in the final minutes of trading. The index ended the day down 0.15%, or 25.05 points, at 16,368.27.

Blame Europe: Stocks Have 'Meh' Day

Another day, another "meh" day for the stock market. While there was no major market-moving news or data released on this particular Monday, investors seemed to be closely monitoring events in Europe. Reports of political instability in Portugal and continued concerns over the debt crisis in Greece weighed heavily on the markets. In addition, a disappointing report on U.S. home sales added to the market's woes. The Dow Jones Industrial Average ended the day down 0.06%, or 9.82 points, at 16,937.26.

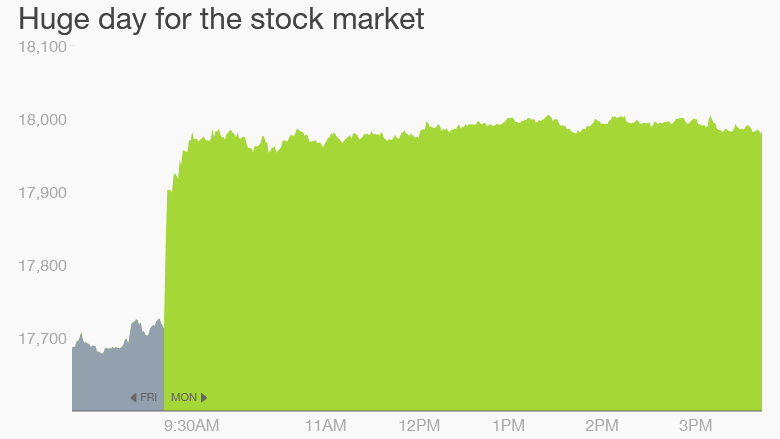

Boom! The Dow Surged More Than 260 Points

March 30, 2015

Investors were in a bullish mood today, as the Dow Jones Industrial Average surged more than 260 points. The rally was driven by a number of factors, including better-than-expected economic data, a rebound in oil prices, and renewed optimism about the global economy. In addition, some investors saw the sell-off in March as a buying opportunity, and this helped to push the market higher. The Dow Jones Industrial Average closed up 1.49%, or 263.65 points, at 17,976.31.

What Did The Dow Jones Industrial Average Do Today?

Money Morning

The Dow Jones Industrial Average had a mixed day today, with the markets struggling to find direction. While there were some bright spots in the U.S. economic data, concerns about slowing growth in China and Europe kept investors on edge. In addition, the ongoing situation in Greece continued to weigh on the markets. Despite the uncertainty, the Dow Jones Industrial Average managed to eke out a small gain for the day. The index closed up 0.16%, or 28.23 points, at 17,408.25.

What Did The Dow Jones Industrial Average (DJIA) Do Today?

Money Morning

After a tumultuous few days, the Dow Jones Industrial Average managed to regain some of its footing today. The market was boosted by a series of positive economic reports, including better-than-expected jobs data and stronger-than-expected retail sales. In addition, investors were heartened by news that Federal Reserve Chair Janet Yellen was optimistic about the U.S. economy. These factors helped to push the Dow Jones Industrial Average up by 0.79%, or 139.55 points, to close at 17,868.76.

Tips, Ideas, and How To: Investing in the Dow Jones Industrial Average

Investing in the stock market can be a confusing and overwhelming experience, especially for beginners. However, with a little bit of knowledge and some careful planning, it's possible to make money in the market. Here are some tips, ideas, and strategies for investing in the Dow Jones Industrial Average:

Tip #1: Understand the Basics

Before you invest in the Dow Jones Industrial Average, it's important to understand how the index works. The Dow is made up of 30 blue-chip stocks that trade on the NYSE and the NASDAQ. These companies, which include Apple, Boeing, and Goldman Sachs, are considered to be a good representation of the U.S. economy. The Dow Jones Industrial Average is calculated by adding up the stock prices of these 30 companies and dividing them by a number called the Dow divisor, which is adjusted periodically to account for stock splits and other factors.

Tip #2: Diversify Your Portfolio

One of the keys to successful investing is diversification. By spreading your money across a variety of different assets, you can reduce your risk and increase your chances of making money. When investing in the Dow Jones Industrial Average, it's important to remember that this is just one index among many. To build a diversified portfolio, you should consider investing in other indexes, such as the S&P 500 or the NASDAQ, as well as in individual stocks, mutual funds, and other assets.

Tip #3: Plan for the Long-Term

Investing in the stock market can be a volatile and unpredictable experience. In order to be successful, you need to have a long-term perspective and plan accordingly. This means setting realistic goals, diversifying your portfolio, and sticking to your investment plan even when the markets are fluctuating. It also means avoiding the temptation to make hasty, emotional decisions based on short-term market trends.

Idea #1: Consider Index Funds

If you're not sure which stocks to invest in, or if you simply want to minimize your risk and maximize your returns, you might consider investing in index funds. These are mutual funds or exchange-traded funds (ETFs) that track a particular index, such as the Dow Jones Industrial Average. By investing in an index fund, you can achieve broad market exposure and potentially earn market-like returns without having to pick individual stocks.

Idea #2: Use Dollar-Cost Averaging

Dollar-cost averaging is a technique that involves investing a fixed amount of money at regular intervals, regardless of the current market conditions. For example, you might decide to invest $100 in the Dow Jones Industrial Average every month, regardless of whether the market is up or down. This can help to smooth out the ups and downs of the market and potentially reduce your risk over time.

How To: Open a Brokerage Account

If you're ready to start investing in the Dow Jones Industrial Average, the first step is to open a brokerage account. A brokerage account is a special type of bank account that allows you to buy and sell stocks, bonds, and other securities. There are two types of brokerage accounts: full-service and discount. Full-service brokerage firms offer a wide range of investment services, including research and advice, but they also charge higher fees. Discount brokers, on the other hand, offer lower fees but fewer services. To open a brokerage account, you'll need to fill out an application and provide some personal and financial information. Once your account is open, you can start buying and selling stocks.

Investing in the stock market can be a lucrative but risky venture. By following these tips, ideas, and strategies for investing in the Dow Jones Industrial Average, you can help to minimize your risk and increase your chances of making a profit. Whether you're a beginner or an experienced investor, the key is to stay patient, stay informed, and stay focused on your long-term goals.

Find more articles about Where Did The Dow Close Today