Where Do You Get Money Orders - If you need to send money via mail or don't have a bank account, money orders are a trusted and secure alternative to cash or personal checks. While they may seem outdated, money orders are still commonly used for a variety of purposes, from rent payments to online purchases. In this article, we will guide you through the process of getting a money order, how to fill it out, and how to verify it. We will also provide tips on how to avoid scams and protect yourself when using money orders.

How to Get a Money Order

Step 1: Find a Location

The first step to getting a money order is to find a location that sells them. Money orders can typically be purchased at post offices, banks, and stores like Walmart, 7-Eleven, and CVS. It's a good idea to call ahead to make sure that a location has money orders available and to ask about any fees.

Step 2: Bring Identification and Payment

When you go to purchase a money order, you will need to bring identification and payment for the total amount of the money order plus any fees. Accepted forms of identification typically include government-issued identification like a driver's license, passport, or state ID. Payment can be made in cash or with a debit card or traveler's checks, depending on the location.

Step 3: Fill Out the Money Order

Once you have purchased your money order, you will need to fill it out. This involves writing the recipient's name and address, your name and address, and the total amount of the money order. Be sure to fill out the money order completely and accurately to avoid any issues or delays.

How to Verify a Money Order

Step 1: Check the Security Features

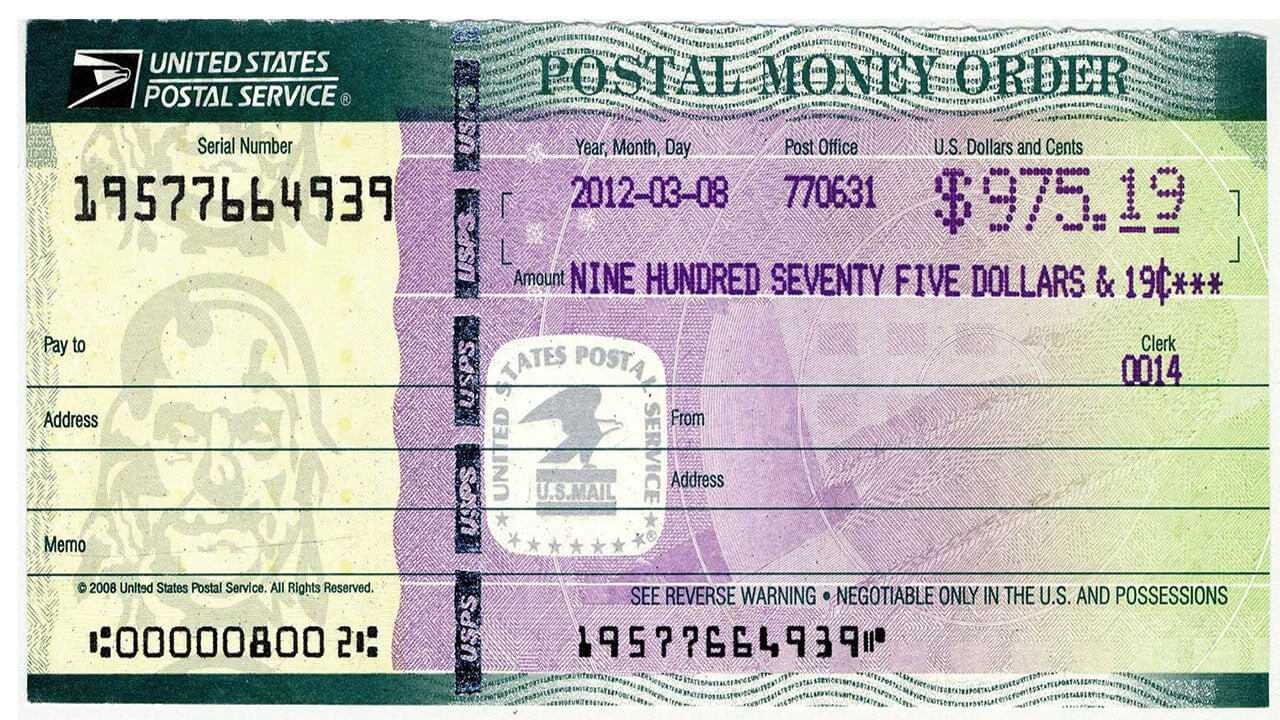

One of the easiest ways to verify a money order is to check for security features. Most legitimate money orders will have watermarks, security threads, and other features that make them difficult to counterfeit. Additionally, the font and print quality should be clear and uniform throughout the money order.

Step 2: Contact the Issuer

If you're still unsure about the authenticity of a money order, you can contact the issuer. The issuer will be able to verify whether the money order is legitimate and whether it has been cashed. Some issuers have online portals where you can enter the money order number and check its status directly.

Step 3: Be Wary of Scams

When verifying a money order, it's important to be wary of scams. Some scammers will send fake money orders or claim to have sent you a money order with a higher amount than you were expecting. Always double-check the legitimacy of a money order before depositing it or sending it. If something seems too good to be true, it probably is.

Tips and Ideas

Here are some additional tips and ideas to keep in mind when using money orders:

- Keep your receipt and any documentation related to the money order, in case you need to track or cancel it

- Never sign a blank money order or one made out to someone else

- Avoid money order scams by only using trusted sources and verifying the legitimacy of the money order

- Consider alternative forms of payment like online transfers or cashier's checks, which may be less expensive and more convenient

- If you're sending a money order for a purchase or service, make sure you receive a receipt or confirmation of the transaction

- Ask about any fees or limits associated with the money order, as these can vary depending on the location and issuer

- Always take precautions to protect your personal information and avoid identity theft when using money orders

Conclusion

Money orders are a secure and reliable way to send money, especially for those who don't have a bank account or prefer not to use cash or personal checks. By following these simple tips and ideas, you can ensure that your money order is authentic and that your transaction is secure. Whether you're paying rent, buying something online, or sending money to a friend or family member, money orders can be a convenient and trustworthy option.

Read more articles about Where Do You Get Money Orders