Where To Mail Tax Return To Irs - Tax season is upon us, and with that comes the overwhelming task of filing our tax returns. One of the most important steps in the process is mailing your tax return to the IRS. It's important to know the correct address for your state, so your return is delivered in a timely manner. Below are the IRS mailing addresses for each state.

How to Check an IRS Tax Return

Are you expecting a tax refund? If so, here's how to check the status of your return:

To check the status of your tax return, you can use the IRS's "Where's My Refund?" tool. This tool will give you the status of your refund, including the date it was sent out or when it will be sent out. You will need to provide your Social Security number, filing status, and the exact amount of your expected refund to access this tool.

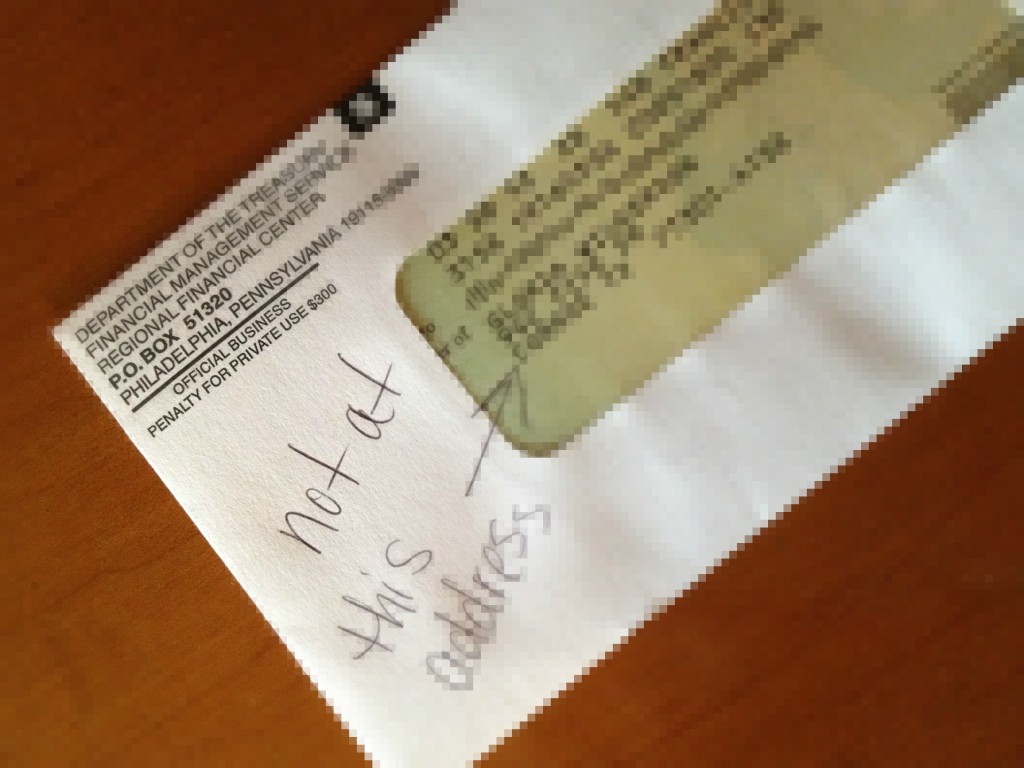

What is this mail in my Informed Delivery?

Did you receive a mail notification in your Informed Delivery and you're not sure what it is?

If you use the Informed Delivery service by the USPS, you may receive a mail notification from the IRS. This notification might include important documents such as a stimulus check or a letter requesting more information about your tax return. If you receive a mail notification from the IRS through Informed Delivery, make sure to open your mailbox promptly to retrieve your mail.

Where do I mail my federal tax return?

Unsure of where to send your federal tax return?

The address you mail your federal tax return to depends on the state you live in and whether you're enclosing a payment or not. Generally, if you're not enclosing any payment or documentation, you can send your return to the IRS processing center for your state. However, it's best to double-check the IRS website to confirm the correct address for your state.

Mailing an Amended Tax Return

Have you made a mistake on your tax return and need to send an amended return? Here's what you need to know:

If you've discovered an error on your tax return and need to file an amended return, you'll need to mail the return to the IRS. The address you'll send it to depends on the state you live in and the type of return you're filing. You must include copies of any schedules or forms that were affected by the change you made, as well as any necessary payment. It's important to make sure all your documents are correct and legible to avoid any delays in processing.

By following these tips and guidelines, you can successfully mail your tax returns and amended returns to the IRS. Remember to double-check the address for your state to avoid any delays in processing. Tax season can be stressful, but with a little attention to detail, you can file your taxes with confidence.

Thank you for reading our guide on mailing your tax returns to the IRS. We hope you found it helpful.

View more articles about Where To Mail Tax Return To Irs